WHAT'S NEW?

Loading...

Mistakes One Must Not Make In Drafting An Employment Agreement

5 Things You Must Know About Tamil Nadu Shops and Establishment Act : Employee Welfare and Rights

5 Things You Must Know About Karnataka Shops and Establishment Act : Employee Right and Welfare

11 Things You Must Know About Maharashtra Shops and Establishment Act : Employee Rights and Fair Treatment

Employer Not Paying Wages After Resignation or Termination (Part 1)

Gratuity Amount Calculation & Rules

Gratuity Amount Calculation & Rules

Gratuity Amount Calculation & Rules. All need to know about The Payment of Gratuity Act and Rules. Visit http://www.shramsamadhan.com/p/payment-of-gratuity-act-rules.html. Click On The Image To Access Main Content

How To Do UAN KYC Update

How To Do UAN KYC Update

How To Do UAN KYC Update. 7 Most Important Thing About UAN KYC Update Procedure. Visit http://www.shramsamadhan.com/p/universal-account-number-uan-employee.html. Click On The Image To Access Main Content

How To Link A PF Account To UAN

How To Link A PF Account To UAN

How To Link A PF Account To UAN. 7 Most Important Things About Linking A PF Account To UAN. Visit http://www.shramsamadhan.com/p/universal-account-number-uan-employee.html. Click On The Image To Access Main Content

How To Download UAN Card or Universal Account Number Card

How To Download UAN Card or Universal Account Number Card

How To Download UAN Card or Universal Account Number Card. 7 Most Important Thing About UAN Card. Visit http://www.shramsamadhan.com/p/universal-account-number-uan-employee.html. Click On The Image To Access Main Content

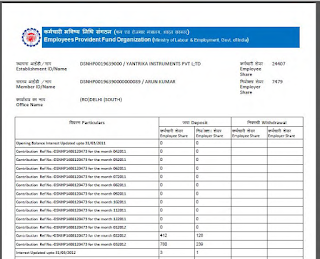

How To Download Provident Fund or PF Pass Book

How To Download Provident Fund or PF Pass Book

How To Download PF Pass Book. 7 Most Important things About Pf Pass Book. Visit http://www.shramsamadhan.com/p/universal-account-number-uan-employee.html

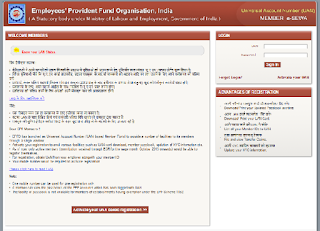

How To Login in PF Account using UAN

How To Login in PF Account using UAN

HOW TO LOGIN IN UAN ACCOUNT OR PF ACCOUNT. 7 MOST IMPORTANT THING ABOUT UAN LOGIN. Visit http://www.shramsamadhan.com/p/universal-account-number-uan-employee.html. Click On The Image To Access Main Content

UAN ACTIVATION : UNIVERSAL ACCOUNT NUMBER ACTIVATION

UAN ACTIVATION : UNIVERSAL ACCOUNT NUMBER ACTIVATION

HOW TO ACTIVATE UAN (UNIVERSAL ACCOUNT NUMBER). 7 MOST IMPORTANT THINGS ABOUT UAN (UNIVERSAL ACCOUNT NUMBER). Visit http://www.shramsamadhan.com/p/universal-account-number-uan-employee.html. . Click On The Image To Access Main Content